Did you know the personal allowance for the current UK tax year is £12,570? This amount plays a significant role in the British tax system and affects how people pay income tax to HMRC If you earn £12,571 or more, knowing about UK tax brackets is important for managing your finances. I’ll walk you through the UK tax rates, showing how your income is taxed at different levels across the UK.

Key Takeaways

- The tax year in the UK stretches from 6 April to 5 April the following year.

- UK personal allowance is frozen at £12,570 for the 2024/25 tax year.

- Income over the personal allowance is taxed at increasing rates, from 20% to 45%.

- Scottish taxpayers face different income tax rates and bands, creating a unique financial scene.

- Knowing where your income fits in UK tax brackets is vital for good financial planning.

- High-income earners must plan carefully around Personal Allowance limits and taxes on savings interest.

- Trustees and non-UK domiciled individuals face a complex tax system with more layers.

Introduction to UK Tax System

The UK tax system is complex, with many tax brackets. It’s important for financial planning and following the law. Knowing how income tax works and the HMRC tax bands helps manage money better.

The importance of understanding tax brackets

Understanding tax brackets is valuable for effective money management. It’s important for both personal and business finances. Knowing tax thresholds and rates makes planning easier, avoiding extra taxes or fines.

Overview of UK tax year and HMRC

The UK tax year starts on April 6th and ends on April 5th the next year. HMRC sets this period for tax collection. They ensure everyone understands their tax obligations through clearly defined income thresholds for the year.

Basic principles of income tax in the UK

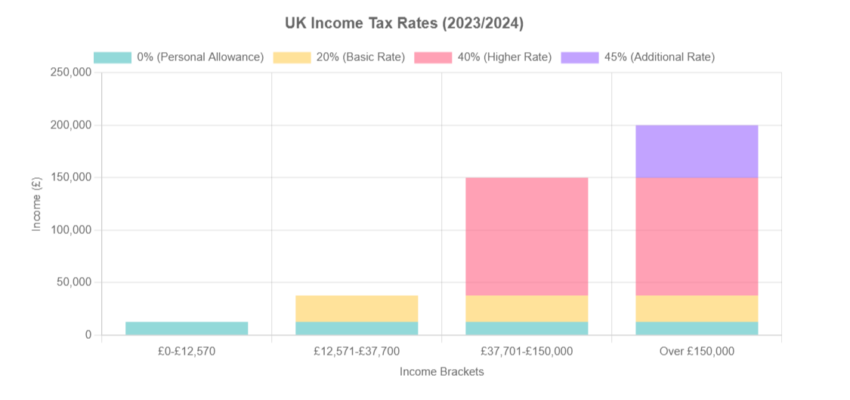

Income tax in the UK follows some main rules. These include a tax-free allowance and different tax bands. The basic personal allowance is £12,570, and then tax rates go up as income does. Rates start at 20%, then 40%, and finally 45% for the highest earners.

Personal Allowance Explained

As we look at the 2024/25 year, it’s vital to know how these allowances work and how they change with your income and life situation.

Standard Personal Allowance

The standard Personal Allowance in the UK for 2024/25 is currently £12,570. This means you won’t pay income tax on this amount, giving most people a tax-free allowance.

How Personal Allowance Changes with Income

Personal Allowance changes with income, if you earn over £100,000 a year. The allowance drops by £1 for every £2 you earn above this. This keeps going until it hits zero, affecting those with a lot of taxable income.

Special Allowances and Adjustments

There are special allowances like Blind Person’s Allowance and Marriage Allowance that can change your tax. You might also get allowances for things like trading or property, each aimed at boosting economic activity or helping families. Knowing about these can help you claim what you’re due and lower your taxes.

Married couples can share their personal allowance, which helps if one partner earns less. There are also tax-free allowances for savings and dividends, showing the importance of knowing all your options to save on taxes.

UK Tax Brackets and Income Tax Rates

Your personal allowance stays at £12,570 if your income is under £100,000 for 2024 to 2025. This allowance is important as it marks the start of taxable income. Then, the UK tax system has different rates: 20% on earnings from £12,571 to £50,270. Earnings up to £125,140 are taxed at 40%. Any income over £125,140 is taxed at 45%.

Dividends have their own tax rates too. For 2024 to 2025, the ordinary rate is 8.75%. Higher earnings are taxed at 33.75% and 39.35%.

There’s a 0% rate for savings up to certain limits, then 20% and 40% as savings go up. The top earners face a 45% tax rate on savings. This shows how important planning is to keep more of your money.

Basic Rate Tax Band

Income range for basic rate taxpayers

The basic rate covers earnings from £12,570 to £50,270. Within this range, a 20% tax rate applies.

Calculation of tax for basic rate band

To figure out tax at the basic rate, first subtract the personal allowance (£12,570) from your income. For instance, with an annual income of £30,000, the taxable amount is £17,430. Then, apply the 20% tax rate to get an income tax of £3,486.

Examples of basic rate tax scenarios

Let’s look at some real-life tax examples. Person A makes £28,000 a year. After the personal allowance, they owe tax on £15,430. This means a tax bill of £3,086. If Person B earns £45,000, they owe £6,486 after the allowance.

| Annual Income (£) | Taxable Income (£) | Tax Owed (£) |

| 28,000 | 15,430 | 3,086 |

| 45,000 | 32,430 | 6,486 |

Knowing about tax codes UK helps with financial planning. Staying updated on changes, like keeping UK income tax bands until at least 2027/2028, helps predict future taxes better.

Higher Rate Tax Band

In the UK, the higher tax bracket covers earnings from £50,271 to £125,140. This band is taxed at 40%, a big jump from the basic rate. It’s crucial to plan taxes carefully in this range.

What does the 40% tax bracket mean? It means your tax jumps from 20% to 40% once you earn over £50,270. For instance, earning £60,000 means paying 20% on the first £37,700 and 40% on the rest. This makes a bigger part of your income go to taxes.

In this bracket, you face reduced savings allowance and more complex pension and dividend tax rules. These affect your overall income.

The 40 tax bracket will require careful tax planning. It’s not just about the higher tax rate. Using tax reliefs like pension contributions and donations can lower your taxes.

Understanding this tax band helps with financial planning and investment choices. It guides decisions on ISAs and pensions, which are good ways to manage taxes in a higher bracket.

Additional Rate Tax Band

At the top of the UK tax system, those earning over certain amounts enter the additional rate tax band. This brings big tax implications and the chance for smart financial planning.

Threshold for Additional Rate Tax

The UK’s additional rate tax kicks in at incomes over £125,140. This group pays a 45% income tax rate from 2022 to 2025. It’s the highest tax rate and affects only a few high earners, adding a lot to tax revenues.

Impact on Personal Allowance

Those earning more than £100,000 see a big drop in their personal allowance. The allowance goes down by £1 for every £2 earned over £100,000. It disappears at £125,140. This means high earners lose the tax-free allowance, which is £12,570 for the 2024 to 2025 tax year.

Strategies for High-Income Earners

UK high earners, especially those in the additional rate tax band, look for ways to cut their taxes. They use pension contributions, getting tax relief at a 45% rate. Investing in ISAs is a wise decision, as it allows individuals to effectively manage their taxes, even with a £20,000 annual contribution limit.

| Tax Band | Rate | Income Threshold |

| Basic | 20% | £12,571 to £50,270 |

| Higher | 40% | £50,271 to £125,140 |

| Additional | 45% | Over £125,140 |

Scottish Income Tax Rates and Bands

Exploring Scottish tax rates shows how they differ from the rest of the UK. Scotland has its own income tax bands and rates. These play a big part in how Scots plan their finances.

Differences from rest of UK

Scotland’s tax system has unique bands and rates not found elsewhere in the UK. This lets the Scottish Government tailor tax policies to Scotland’s needs. For instance, Scotland’s higher rate of 42% kicks in at £43,663, unlike England’s 40% at £50,271.

Scottish tax brackets explained

The Scottish tax system has several tiers, each for different income groups. Income between £12,571 and £14,876 pays 19% tax, while earnings over £125,140 are taxed at 48%. This tiered system adjusts tax based on income, easing the load on lower earners and increasing it for those with higher incomes.

Implications for Scottish taxpayers

The unique tax rates and bands in Scotland affect how much tax people pay. The system aims to make taxation fairer, with higher earners paying more. This policy mainly impacts those with higher incomes, who face a 45% tax rate on earnings between £75,001 and £125,140.

The Scottish tax system is progressive, showing a commitment to fairness and responsibility. Knowing these differences helps Scots manage their taxes better and use tax benefits based on their income.

| Income Range (£) | Tax Rate |

| 12,571 to 14,876 | 19% |

| 14,877 to 26,561 | 20% |

| 26,562 to 43,662 | 21% |

| 43,663 to 75,000 | 42% |

| 75,001 to 125,140 | 45% |

| Over 125,140 | 48% |

Tax-Free Allowances and Reliefs

In my journey to understand the UK’s tax-free allowances and reliefs, I’ve found many ways to reduce taxable income. These include tax relief measures and specific allowances to help individuals financially.

- National insurance contributions, especially with the national insurance tax cut affecting take-home pay.

- The Marriage Allowance lets a non-earning spouse transfer up to £1,260 of their allowance to the working spouse. It’s a great way for couples to help each other financially.

- The Blind Person’s Allowance is an extra tax relief, worth £3,070. It helps those eligible deal with financial challenges.

For savings, UK tax allowances let you keep up to £1,000 in savings interest tax-free if you’re a basic-rate taxpayer. This drops to £500 for higher-rate taxpayers, making it important to plan our savings to use these tax relief UK benefits.

Let’s look at tax-free income from trading and property rental:

| Source | Allowance |

| Trading | £1,000 tax-free |

| Property Rental | £1,000 tax-free |

It’s vital to keep up with UK tax allowances and national insurance tax cut options as they change each year. They can greatly affect financial planning and what you owe in taxes. By matching my income and investments with the right allowances and reliefs, I make sure I’m saving as much tax as I can.

Conclusion

The number of people in the higher 40% tax bracket has grown from 3.5% in 1991–92 to a predicted 14% by 2027–28. This means more people will need to understand tax better.

It’s not just about numbers. The fact that over one in eight nurses and one in four teachers could be in the higher tax bracket by 2027–28 shows how tax rules are changing. This change affects many people’s lives.

Labour’s plan to keep corporate tax at 25% shows they’re serious about fair taxation. They aim to stop tax avoidance and tweak rules on companies and international tax deals. This could change how both individuals and companies deal with taxes. We should watch for updates in the Autumn Budget on tax policies.

My job is now about giving people the knowledge to handle these tax changes. It’s about adjusting your finances because of tax freezes, which could cut household spending by 1.4% by 2027–28. It’s also about knowing how tax changes might affect jobs in areas like education and healthcare.

Being aware of tax changes is a powerful way to plan for the future. It helps you make smart financial decisions. So, understanding the tax system is key to a strong financial future.

*

FAQ

What are the current UK tax rates for the tax year 2024/25?

For the 2024/25 tax year, the main UK income tax rates are the basic rate of 20% for incomes between £12,571 and £50,270. The higher rate of 40% applies to incomes between £50,271 and £125,140. The additional rate of 45% is for incomes over £125,140.

When does the tax year in the UK begin and end?

The tax year in the UK starts on 6 April and ends on 5 April the following year. So, the tax year 2024/25 begins on 6 April 2024 and ends on 5 April 2025.

What is the standard Personal Allowance for the 2024/25 tax year?

The standard Personal Allowance for the 2024/25 tax year is £12,570. This is the amount of income not subject to income tax for a typical taxpayer.

How does income over £100,000 affect the Personal Allowance?

If your income is over £100,000, the Personal Allowance is reduced by £1 for every £2 above that threshold. This means the Personal Allowance is gradually reduced and eventually eliminated for those with higher incomes.

Are there any special allowances I should be aware of?

Yes, there are special allowances like the Marriage Allowance, Blind Person’s Allowance, trading and property allowances. These can affect your taxable income and potentially reduce your tax liability.

How do I calculate the tax I owe if I’m a basic rate taxpayer?

To figure out your tax as a basic rate taxpayer, first subtract your Personal Allowance from your total income. Then, apply a 20% tax rate on what’s left. For example, if you earn £30,000, you’d pay 20% on £17,430 (£30,000 – £12,570), which is £3,486.

What income is taxed at the higher rate of 40%?

Income between £50,271 and £125,140 is taxed at the higher rate of 40% in the 2024/25 tax year. This applies only to the part of your income within this range, not your whole income.

Are there different income tax rates and bands for Scottish taxpayers?

Yes, Scottish taxpayers face different income tax rates and bands. They pay a starter rate of 19%, a basic rate of 20%, an intermediate rate of 21%, a higher rate of 42%, and a top rate of 48% on income over £125,141.

Can I receive any relief on my national insurance contributions?

You might get relief on your national insurance contributions under certain conditions. This includes eligibility for certain benefits or pensions, or if you’re a low earner. Always check the latest guidelines or consult a tax professional for advice tailored to your situation.